Tokenomics are an essential factor in creating a new cryptocurrency. They entail a wide range of components including the token’s supply, distribution, vesting mechanisms, burning, and utility, among others. The combination of these features determines whether a project can hold the investor’s interest for the long haul and outlive its competitors. In essence, tokenomics help users realize the potential value of a blockchain project and its viability.

Consequently, creating sustainable tokenomics is crucial to encourage the growth of both the community and the ecosystem. With this in mind, the Dogechain team had a challenging task at hand when designing the $DC economic model.

The scope of the model was vast and needed to address multiple elements (supply, distribution, longevity, DAO etc.) in order for token holders to be aligned with the long-term vision of the project.

This article will help you understand the veDC tokenomics model and the benefits it provides for the long term. Additionally, it will provide an in-depth understanding of the locking mechanisms and how they integrate with further token distribution, staking, voting, and supply control. But first, let’s explore the idea behind veTokenomics and what they represent.

What Are veTokenomics?

Vote-Escrow Tokenomics or veTokenomics is a cryptocurrency economic model that requires tokens to be locked for a specific amount of time to access advanced utilities of the token. The model incentivizes long-term participation and effectively reduces the available supply on the market. The idea behind constricting the circulating supply is to organically contribute towards the price increase of the token in the long term.

In return for their trust, users receive veTokens, which are non-transferable and cannot be sold on the open market. Instead, their purpose is to unlock advanced utilities in the ecosystem. These include higher rewards from emissions, voting power in the governance of the network, or other clever incentives.

So, to actively participate in the ecosystem’s governance or get access to additional yields, you need to lock up tokens and sacrifice liquidity. This way, the mechanism removes tokens from the circulating supply, while simultaneously incentivizing ownership of the tokens over long periods of time.

Origins of veTokenomics

This tokenomics mechanism was first introduced by Curve. Curve provides incentives in LP tokens when providing liquidity pools. They can then deposit these LP tokens into the Curve gauge, which yields the Curve DAO token (CRV).

Additionally, the fees generated by Curve.finance are split 50:50 between LPs and veCRV holders. To get veCRV, users need to timelock and give up the liquidity of the CRV governance tokens. In this case, three major benefits arise:

- Voting for rewards for liquidity pools

- Earn an additional portion of the fees

- Boost staking rewards

Once CRV is locked, users can’t transfer or sell their tokens, until the lock period is over. This period can vary from 1 month to 4 years, where longer timelocks provide higher veCRV returns. The initial wave of DeFi governance tokens was farmed and dumped, with nothing substantial holding up the price. There was no genuine demand for these tokens outside of speculation and governance rights.

Fast forward two years later, and more than half of the total supply of CRV is locked for multiple years, with the price recovering significantly after the implementation of the veCRV model. Additionally, the TVL of Curve literally skyrocketed, with lockups exceeding 80% at one point, constricting the circulating supply considerably.

Advantages and Disadvantages of veTokenomics

Like any tokenomics model, there are benefits and drawbacks to veTokenomics. Some crucial benefits include:

- Provides higher earning incentives to holders that align with the long-term vision of the project.

- Removes supply out of circulation by incentivizing lockups for long periods of time. This plays in favor of the price of the token as it reduces selling pressure over the long term.

- Provides added utility for the token which increases demand and buying pressure.

- Aligns the priorities of different types of stakeholders (stakers, traders, tokenholders).

Some of the drawbacks of this model include:

- A reduced number of potential investors as not everyone is willing to sacrifice their liquidity for extended periods of time.

- The best returns come with the caveat of having to lock for 4 years.

In his case, the benefits outweigh the disadvantages by a large margin, proving the efficacy of veTokenomics in general.

Context for the veDC Model

Each project implements veTokenomics in a different manner, to adapt to the emissions and utility of its own token. To make a case for Dogechain, let’s have an overview of the $DC token distribution model.

The Dogechain platform and the $DC token were created with a community-first mindset. Consequently, 58% of the total supply has been allocated to community initiatives such as airdrops, grants, and the ecosystem DAO fund. To have a more thorough overview of the allocations and vesting periods, you can check out our Dogechain tokenomics documentation.

In this context, it only makes sense that the tokenomics are designed around a concept that incentivizes long-term holding. Since a lot of the supply emissions exist to reward the community for their support, selling pressure could become an issue in the long term and result in continuous negative price action.

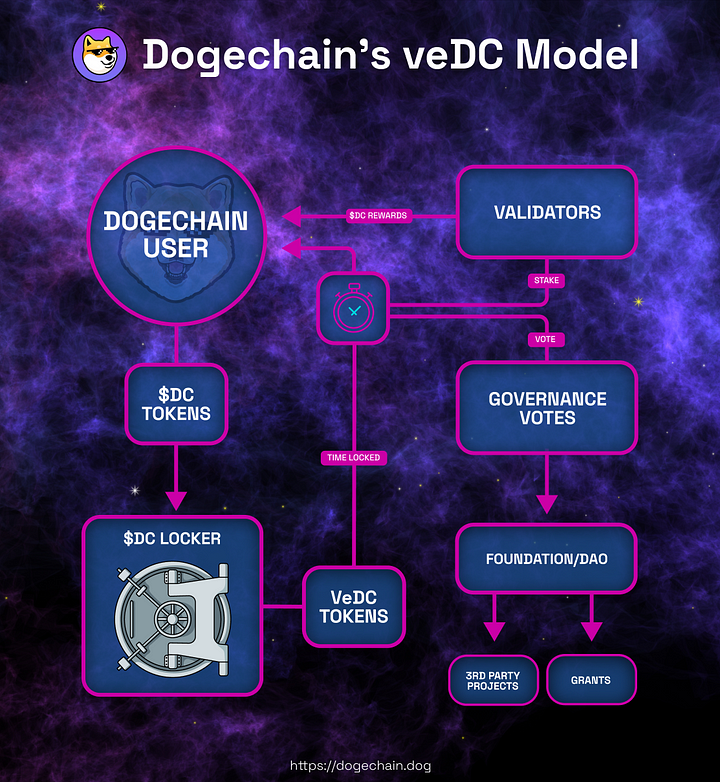

For this reason, the Dogechain team has implemented the veDC lockup mechanisms as depicted below.

The veDC Locking Mechanism Explained

The veDC model has been entirely integrated with the tokenomics of Dogechain. It’s an essential piece of the puzzle that gives $DC a viable economic outcome in the long term, providing various benefits to those using it.

On its own, the $DC token can only be used as a speculative asset and traded on the open market. However, when locked in the veDC model, it gains two major use cases in the ecosystem:

- Can be used for staking in the PoS consensus model.

- Can be used for governance and voting power in various decision-making procedures.

Once users lock up their $DC in the veDC locker, they will receive $veDC tokens, in proportion to the length of their lockup time. More precisely, lockups will provide the following ratios of $DC to $veDC:

- 1 month — x1.1 amount of $veDC

- 3 months — x1.2 amount of $veDC

- 6 months — x1.5 amount of $veDC

- 1 year — x2.0 amount of $veDC

- 2 years — x3.0 amount of $veDC

- 3 years — x4.0 amount of $veDC

- 4 years — x8.0 amount of $veDC

When the lockup time expires, users can burn the $veDC tokens to retrieve their locked $DC and reclaim their liquidity.

In a nutshell, this ratio distribution means that users that lock up their $DC for the maximum time period will receive x8 the amount of $veDC tokens. Consequently, long-term support provides increased staking rewards or more governance power even to more modest $DC token holders.

Another interesting feature of the Dogechain model is that users will be able to lock tokens on different timeframes. This allows them to remain flexible with their liquidity and have portions of $DC locked for both long and short periods. Depending on their commitment, market sentiment, or portfolio allocation for staking and voting, users can apply various veDC strategies that provide them optimal exposure to both liquidity and yields.

Finally, it’s worth noting that $veDC tokens are neither tradable nor transferable. They can only be staked with validators or used for voting power and governance proposals.

Use Cases for $veDC Tokens

As previously mentioned, $veDC tokens unlock two major use cases for $DC holders.

$veDC staking

Users can stake $veDC with validators on the network to help secure the chain and participate in its PoS consensus. Users that delegate $veDC with validators will receive a portion of the validator reward, in liquid $DC tokens. Note that the rewards come fully unlocked right off the bat and can be either held, traded, or locked in veDC.

Consequently, higher lockup periods of $DC automatically provide exponentially higher $DC rewards when staking with validators. In addition, they allow long-term committed users to become validators with smaller upfront investments when taking advantage of longer timelocks.

$veDC Governance

The second crucial use case for $veDC is to be able to create and vote on governance proposals on the chain and get rewarded for participation. The scope of the proposals can vary, ranging from protocol improvements to staking rewards.

However, a major portion of the voting mechanism will be directed toward the Ecosystem DAO fund. This wallet holds 29% of the total supply of $DC tokens that will be used to provide grants to projects building on the chain. Voters will be able to decide on funding for projects and actively participate in their development.

What’s more, grants will be distributed using a wide range of methods that benefit both the projects and the voters. One example could be that voters could be rewarded additional LP rewards in $DC and the project’s tokens if they voted for the project that received a grant.

Consequently, the governance model not only provides users with decision-making capacity but also allows them to access a new stream of revenue through active participation in the ecosystem.

veDC Tokenomics Benefits Summarized

veTokenomics have proven their efficiency in multiple protocols in the past and they particularly shine with the veDC model. To sum up, the veDC model:

- Increases the utility of $DC by enabling users to stake and vote.

- Provides holders with increased yields from staking.

- Allows voters to access additional revenue from projects they have voted for.

- Incentivizes long-term holding by providing higher yields for longer lockup periods.

- Provides flexibility to users by allowing them to lock their tokens in mixed timeframes.

- Reduces the selling pressure from airdrops, grants, and rewards.

- Constricts the circulating supply and provides on-chain evidence of lockups.

The combination of these advantages should provide long-term viability for the $DC token economy while simultaneously aligning the goals of the project with its stakeholders.

Dogechain is bringing DeFi & long awaited utility to Dogecoin. Join the family!

Website | Twitter | Telegram | Discord | Reddit | TikTok